Fees

There are 4 types of fees on Jupiter Perps:

- A flat 0.06% (6bps) base fee, applied on notional position size.

- A price impact fee, simulating the orderbook impact given notional size.

- Borrow fee, paid hourly on open positions, based on notional size.

- Transaction & Priority fee to create trade requests.

Base Fees

A flat rate of 0.06% of the position amount is charged when opening or closing a position. This base fee is also charged when a position is closed partially.

Calculating Base Fees

Position size * 0.06% = Base Fee

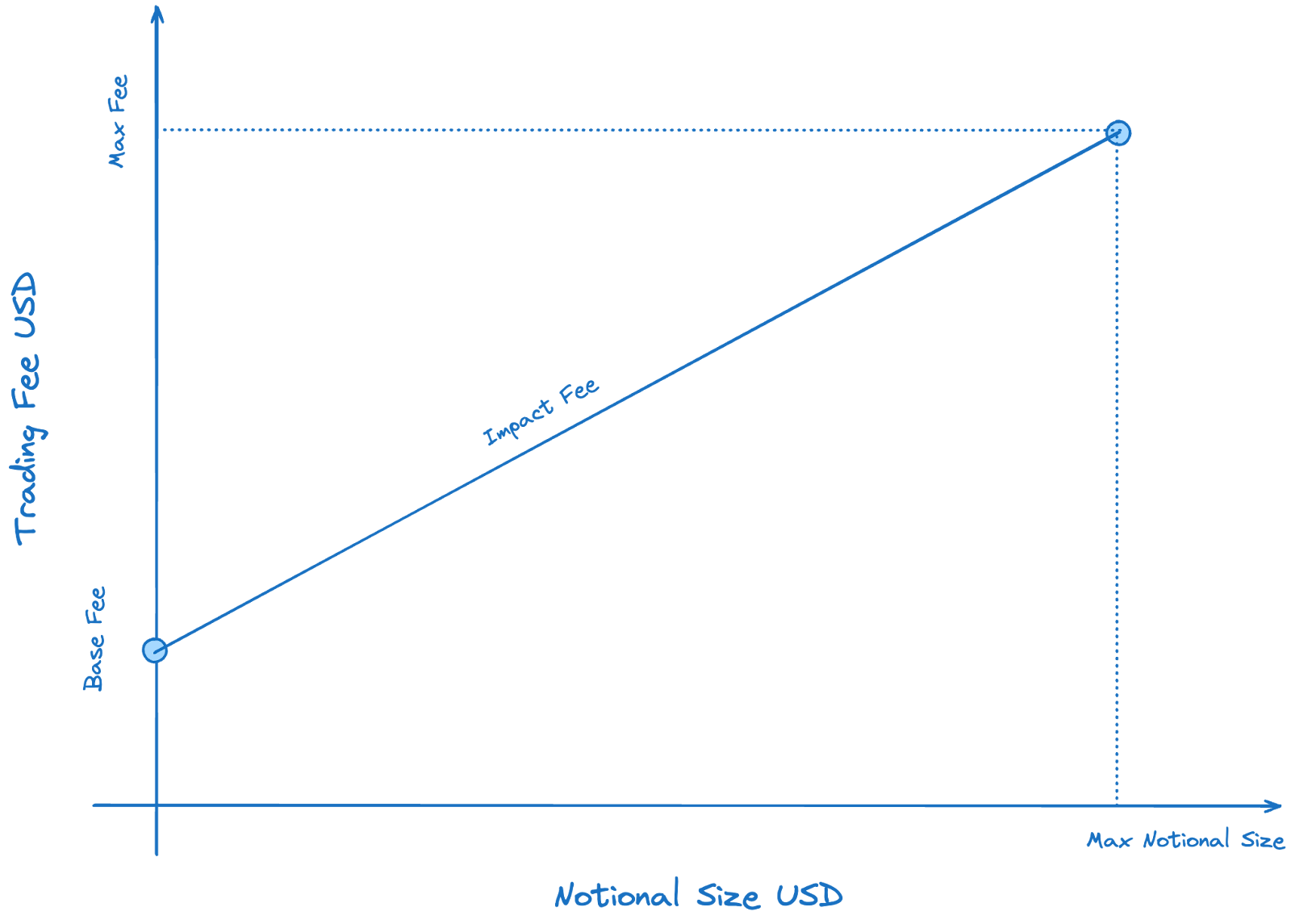

Price Impact Fees

Large trades on the Jupiter Perpetuals exchange inherently incur no price impact since token prices are sourced from price oracles. While this is favourable for traders, it poses risks to the Jupiter Liquidity Pool (JLP).

- Large, profitable trades can put stress on the liquidity pool’s reserves.

- The platform becomes more vulnerable to potential order manipulation.

To address these risks, Jupiter Perpetuals implements a price impact fee. This fee is designed to simulate trading conditions in traditional exchanges, where larger orders typically experience more price slippage due to limited liquidity at each price level.

Benefits of Price Impact Fees

Trader Incentives:

The fee encourages traders to consider the size of their trades, where larger trades will incur higher price impact fees. Also, splitting large orders to smaller sizes can expose traders to price changes between updates from the oracle.

Fair Compensation to JLP Holders:

JLP Pool receives trading fees, whether traders open large trades or split them up. This keeps the liquidity pool balanced and protects it from excessive depletion.

Market Integrity:

The fee structure mimics traditional order book dynamics, where the fee is proportional to the impact a trade might have on the market, making the environment fairer for both traders and liquidity providers.

Calculating Price Impact Fees

(revisit)

Borrow Fees

On the Jupiter Perpetuals exchange, traders can open leveraged positions by borrowing assets from the liquidity pool. Unlike other exchanges that charge funding rates, Jupiter Perps uses a borrow fee system. The borrow fees compound hourly based on the amount borrowed for the leveraged position.

Borrow fees are continuously accrued and deducted from your collateral. This ongoing deduction has two important consequences:

- Your effective leverage increases over time as your collateral decreases.

- Your liquidation price moves closer to the current market price.

It's crucial to regularly monitor your borrow fees and liquidation price. Failure to do so may result in unexpected liquidation, especially during periods of high market volatility or extended position duration.

The hourly borrow rate for assets can be found in the Borrow Rate section of the trade form.

Benefits of Borrow Fees

Compensation for Liquidity Pool:

Borrow fees compensate the JLP Pool for providing assets to traders. This ensures the pool remains healthy and can continue to support trading activity.

Risk Mitigation:

Borrow fees act as a deterrent against excessive borrowing. By charging a fee for borrowing, the platform discourages traders from taking on excessive leverage, which could lead to significant losses.

The borrow fees are reinvested back into the JLP Pool, boosting its yield and liquidity. This also helps align the token mark price with its spot market price.

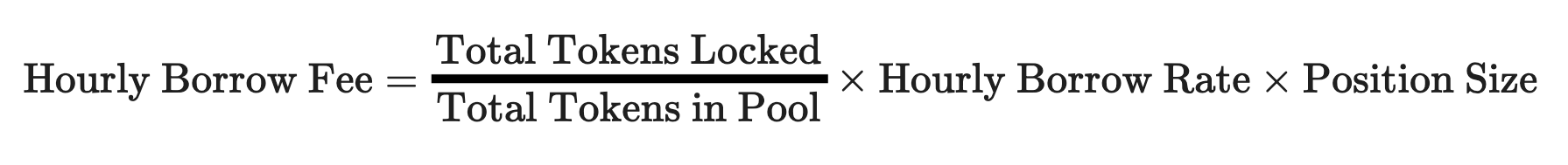

Calculating Borrow Fees

The hourly borrow fee is calculated using the following formula:

| Term | Description |

|---|---|

Total Tokens Locked | Tokens locked in all open positions |

Total Tokens in Pool | Tokens deposited into the liquidity pool for the position's underlying token |

Utilization | The proportion of tokens in the pool that are currently locked in open positions |

Hourly Borrow Rate | The base rate charged for borrowing, which varies by asset |

Position Size | The USD value of the leveraged position |

Example

For example, assume the price of SOL is $100. The SOL liquidity pool has 1,000 SOL under custody and has lent out 100 SOL (i.e, utilization is 10%). A trader opens a 100 SOL position with an initial margin of 10 SOL. The remaining 90 SOL is borrowed from the pool to open the leveraged position. Assume that the hourly borrow rate for SOL is 0.012%:

Position Size in SOL: 100 SOLTotal Tokens Locked: 100 SOL (position size) + 100 SOL (utilized SOL in pool) = 200 SOLTotal Tokens in Pool: 1,000 SOL (existing custody) + 10 SOL (user collateral) = 1,010 SOLUtilization: 200 SOL / 1,010 SOL = 19.8%Hourly Borrow Rate: 0.012% (0.00012 in decimal format or 1.2 BPS)

Calculation:

Hourly Borrow Fee = (200 / 1010) * 0.00012 * 10000 = 0.238

This means your position will accrue a borrow fee of $0.238 every hour it remains open.

How does the Jupiter Perpetuals contract calculate borrow fees?

Due to Solana's blockchain architecture, calculating funding fees in real-time for each position would be computationally expensive and impractical. Instead, the Jupiter Perpetuals contract uses a counter-based system to calculate borrow fees for open positions.

The pool and position accounts maintain two key fields:

- The pool account maintains a global cumulative counter through its

fundingRateState.cumulativeInterestRatefield, which accumulates funding rates over time - Each position account tracks its own

cumulativeInterestSnapshotfield, which captures the global counter's value whenever a trade is made: when the position is opened, when its size is increased, when collateral is deposited or withdrawn, or when the position is closed

To calculate a position's borrow fee, the contract takes the difference between the current global funding rate counter and the position's snapshot, then multiplies this by the position size. This approach enables efficient on-chain calculation of borrow fees over a given time period without needing real-time updates for each position.

The example below demonstrates the borrow fee calculation:

// Constants:

BPS_DECIMALS = 4 // 10^4, for basis points

DBPS_DECIMALS = 5 // 10^5, decimal basis points for precision

RATE_DECIMALS = 9 // 10^9, for funding rate calculations

USD_DECIMALS = 6 // 10^6, for USD amounts as per the USDC mint's decimals

// Main calculation:

1. Get the cumulative funding rate from the pool account:

cumulativeFundingRate = pool.cumulative_interest_rate

2. Get the position's funding rate snapshot:

fundingRateSnapshot = position.cumulative_interest_snapshot

3. Get the position's funding rate interval:

fundingRate = cumulativeFundingRate - fundingRateSnapshot

4. Calculate final borrow fee (USD):

borrowFeeUsd = (fundingRate * position.size_usd) / (10^RATE_DECIMALS) / (10^USD_DECIMALS)

Calculating Programmatically

This code repository contains the examples on calculating the different fees programmatically.

References

Jupiter is working with experts like Chaos Labs and Gauntlet to optimize and maintain a fair, safe and competitive environment by analyzing different fee structures and their impact on the exchange. Here are some of the references on the recommendations.